UltraViolet light scanning

Cheques are very a common means of payment, but they are not emitted by central Banks, and the degree of compliance with centralised standards varies amongst different countries. Even if magnetic printing is present and functional, it is a widely accessible technology and, alone, does not grant any acceptable level of protection against fraud.

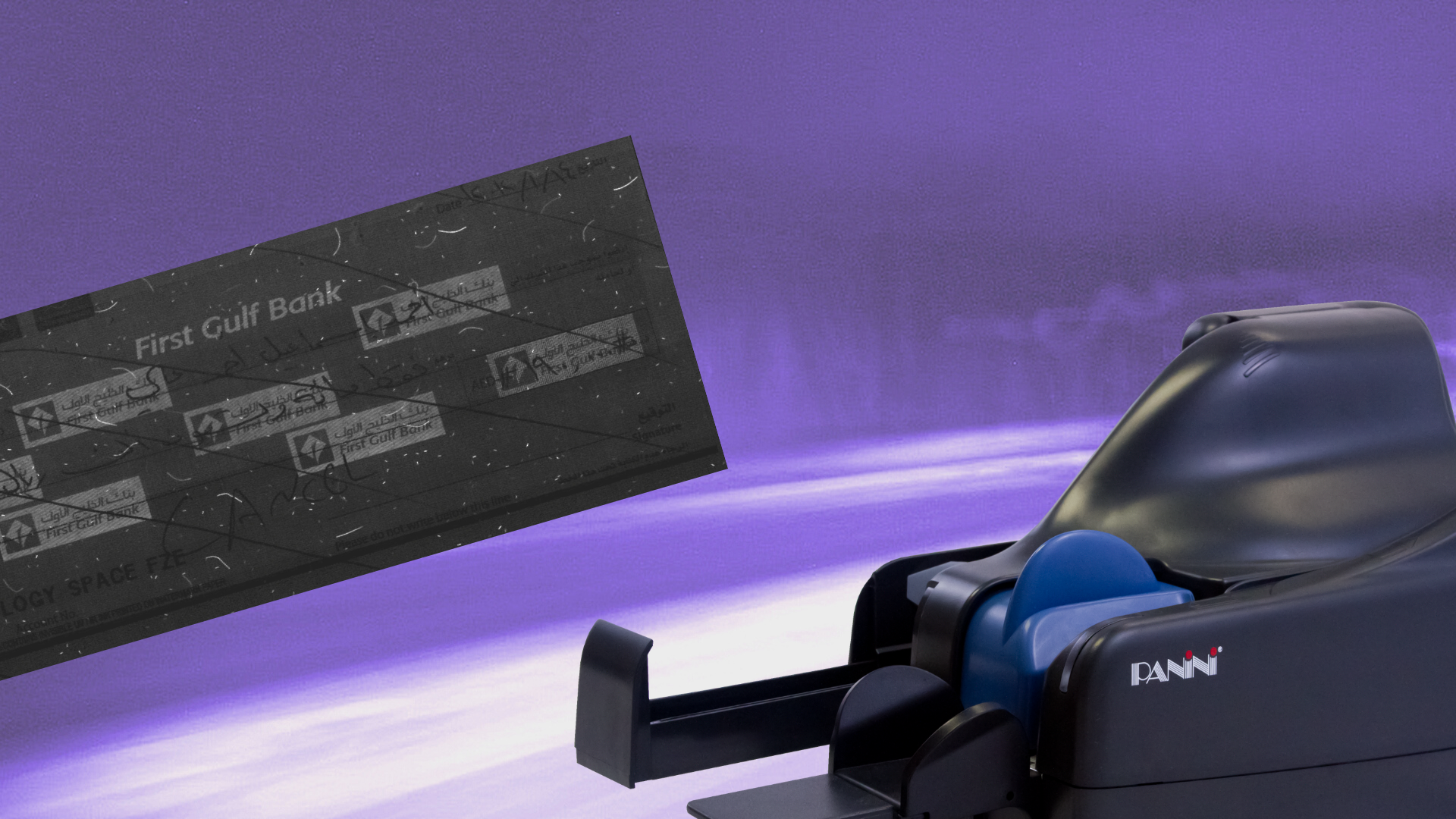

The approach to protect either the cheque stock itself and/or the layout's sensitive areas (amount, payee, signature) is very logical: a special ink that reacts to UltraViolet light can be used on the surface as a coating or embedded in the paper fiber. Then, UV cameras can be easily integrated into a cheque scanner to leverage such ink.

-

Secure

An efficient method to prevent fraud.

-

Trusted

Vision X widely used in UV markets.

-

Fast

Addition of UV image with no significant performance loss.

The challenges of UltraViolet light scanning

UltraViolet light scanning poses at least a couple of issues to the testing phase that follows.

First, UV coated cheques are best inspected automatically rather than manually, which would take too much time and create processing bottlenecks. Thanks to the decreasing cost of UV LEDs, it has become possible to manufacture contact image sensors (CISs) having full RGB and UV capability, both embedded in the same case. This enables full image capture automation where, in the same pass and with equivalent performance, a 200 DPI UV image is returned in parallel with the standard gray level acquisition. This results in an additional image that can be checked for anti-fraud purposes, besides the standard ones used to extract payment information.

Second, what does the inspection expects to find? Just a generic UV content, or (for instance) a bank logo printed with UV ink? And if so, which logo?

Ideally, a country with a Central Bank who wants to push UV as a standard should define what the UV content should be, valid for all banks in the country and easily detectable by automated means. Instead, in many countries adopting the UV standard (like India, Pakistan, Philippines, parts of Africa and Latin America, etc.), it is usually up to each bank to include its own logo and to update it when appropriate. With banks appearing, closing down, merging and changing their branding, it becomes complicated to create a countrywide, stable logos database which could be used by specific software; the result is that the logo is oftentimes still checked visually by bank staff… but still much more efficiently than by passing each paper cheque, individually, under a UV lamp.

"The deadline was tight but they delivered in time and we had an excellent experience with Panini products"

Panini’s formula for reliable UltraViolet light scanning

The Panini Vision X range has been available with the UV front image scanning option for many years, ensuring the platform’s considerable success in many UV adopting markets – also in its AGP (advanced graphics printer) and P (two-pocket) versions.

In India, for instance, more than three-fourths of the country’s top 20 banks use Panini’s image-based cheque truncation technology, which officially started in 2008 with a pilot project in the Delhi region and was enriched shortly afterwards with the UV requirement in order to expand to the entire country.