Everest Fleet Management

Make sure Panini intelligent devices always operate as expected.

EN – Globalarrow_forward

EN – Globalarrow_forward

Italiano

Italiano Español

Español Português

PortuguêsPanini's universal identity platform revolutionizes your physical channel by consolidating a number of essential authentication & identity verification functions in a minimized footprint.

BioCred delivers security, convenience and privacy via its unique and patented fingerprint-based biometric authentication system, as well as supporting several other important in-presence applications such as ID document verification and electronic signature. All this is achieved via a clever design effort whose result improves how customers are served and how spaces are used, creating a better user experience, increasing efficiency in customer-facing processes and protecting the Institution against identity theft and impersonation fraud.

BioCred is suitable for Financial Services, other public-facing industries with repeat customers (healthcare, hospitality, and more) and even retail – wherever it makes sense to address both authentication and other needs via an integrated, advanced and highly ergonomic platform.

FBI-certified fingerprint-based customer authentication with offline matching

No privacy concerns because the customer keeps their own credential

Compatible with alternative authentication methods

Professional ID card scanning as part of identity verification/KYC

Touch display usable for e-signature and to allow user choices

Our research reveals that a majority of Institutions are either already using or strongly considering biometric authentication in their branches as a way to improve customer service and fight identity fraud. The resulting credential is delivered to the customer in two forms: a QR code and an NFC token; the Institution does not keep a copy, which is good news for both parties.

No Institution, however, will feel comfortable with an additional device in their peripherals lineup to cover a single function. Consolidation is Panini’s answer, alongside excellence in all the solution’s functionalities: a single, intelligent device capable of ergonomically interacting with both the service reps and the walk-in customer, while streamlining processes, reducing cable clutter and saving precious space.

Surprise your customers, save their time and yours, and close decisive business more easily.

While everyday communications and transactions are rapidly shifting to digital and mobile, Financial Institutions and other businesses are well aware that the most valuable customers are the ones they also – more or less frequently – meet in person. These customers cannot be offered an onboarding or transactional in-person experience which is less efficient or secure than what they may be already used to online.

That’s where BioCred comes into play: at the sales desk or at the teller station, you can offer secure authentication (biometric or more traditional -document-based), scan ID documents for KYC and sensitive processes and allow e-signatures via fingerprint or stylus.

BioCred is designed to enable a variety of customer-facing applications with maximum usability and ergonomics, while letting the Institution retain control over the settings and the outcome of each operation.

The Panini BioCred is usable at the sales desk or at the teller station, and meant to deliver in-branch customer authentication at its core – but it can do much more.

Authentication can be biometric, fingerprint-based, or carried out via other (legacy) methods. Other functionalities usable in physical branches are ID card scanning (for onboarding or for sensitive transactions authorization), e-signature and digital signage.

During customer enrollment, which includes the scanning of two fingers, BioCred creates an encrypted and digitally signed biometric credential which is delivered to the customer in the form of a QR code on their smartphone app, and a physical NFC token (keyring fob, card, etc.) for them to save. The two forms of credential back each other up in case of loss, while the Institution will not keep a copy – thus safeguarding privacy and removing the need to ensure the storage is secure. When visiting a branch or store, the customer will scan or read their credential (which will allow them to be greeted by name), then match it to the finger(s) when requested, offline, to complete their secure authentication.

BioCred will also allow other forms of authentication such as chip & PIN (which requires a PCI/EMV certified module, also usable for payments with a software upgrade) or by reading their ID document via scan module (optional) or barcode reader (included).

BioCred can read or scan various types identity documents as part of the Institution’s identity verification and KYC/AML processes – which phase usually includes sending the images and data to a cloud-based document verification service.

ID cards and drivers’ licenses containing barcodes can be read via the included barcode reader, while for a deeper verification, document high-resolution images can be captured via the optional ID scan module, which is fastened below the main unit and does not require additional cables. Scanning is single sided, so a full card-sized document scan requires two passes. BioCred cannot read passports.

An optional software functionality allows to read digital documents such as the mDL in the United States, while chip-inclusive ID cards can be first unlocked by reading their MRZ (machine-readable zone) code via the ID scanning module, then the full data on their chip read via NFC via a simple tap.

BioCred’s touch LCD display, besides allowing customer interaction, can capture their signature via stylus (optional) and embed its shape into a contract or agreement via a dedicated software functionality, which will operate per the procedural and legal requirements of the relevant market (if applicable).

Instead of a manual signature’s shape, BioCred can also embed the hash of the customer’s fingerprint into the document, as an alternative and even more secure form of acceptance (where allowed by legislation).

When using the biometric authentication feature, the customer’s fingerprint is hashed and embedded in a encrypted credential that is returned to the customer so that he or she can keep, protect and use it, while the Institution will not retain a copy, thus eliminating the need to justify the collection of the customer’s biometric data and protect it as sensitive information.

ID card scanning modules are are optional, and can either be ordered up front or added at a later time via depot service (in-field upgrade is not possible).

Several software-driven functionalities are also optional and can be enabled via software key. Please contact us for full details.

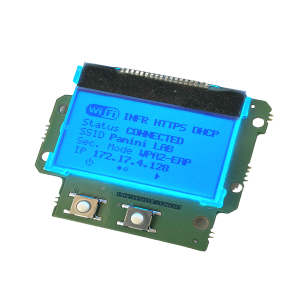

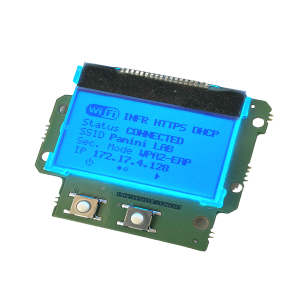

Thanks to Panini’s unique and patented Everest intelligent architecture, BioCred can connect directly to the LAN via Ethernet or Wi-Fi (optional dongle required), and it can run applications on-board.

Communication with the unit is carried out via HTTPS secure protocol, with no need to install and maintain APIs or drivers, and the host can use any Operating System. The Institution’s staff can interact with the unit via their own terminal, while the customer will use the interactive touch display for function selection and other real-time choices.

BioCred features an elegant, footprint-saving design, and the addition of the optional ID scan module only adds to its height.

Dimensions for the base unit are 145 mm – 5.7” (width) x 137 mm – 5.4” (depth) x 188 mm – 7.4” (height), and the weight is around 730 g – 1.6 lb.

Dimensions including the ID scan module are 145 mm – 5.7” (width) x 157 mm – 6.2” (depth) x 238 mm – 9.4” (height), and the weight is around 1.04 Kg – 2.3 lb.

The following software platform is compatible with BioCred.

Make sure Panini intelligent devices always operate as expected.

Two locations and a worldwide network of qualified Partners make sure Panini is present wherever you need us.

Find a Panini Partner