Pierpaolo Bubbio - Technology Assessment and Strategy Director

The Check Truncation Act approval in the United States, signed by George W. Bush in 2004, opened the world’s largest check processing market to check scanner manufacturers.

At the time, several Italian players were aiming to carve out a niche in that market including Panini, CTS Electronics, SEAC Banche, Walther, HTL.

It might seem surprising to find so many Italian companies in the check scanning industry, but this has a clear historical foundation. In 1992, Italy became the first country in the world to implement check truncation at the teller window.

At that time, this was achieved without the use of images and only relying on the magnetic MICR codeline. Some may remember that period because Italian bank tellers began cutting off a corner of deposited checks to mark them as “already processed” and to prevent double deposits.

Panini was there from the early 1990s with a small magnetic-only reader called L1, but more than a decade would pass before the U.S. Truncation Act presented more complex design challenges and significantly increased market volumes.

After achieving success in Italy, where Panini supplied large sorting machines to nearly every Italian bank, Ugo Panini, then CEO and owner, decided in 1995 to establish Panini North America in Dayton, Ohio.

The hope was, naturally, to bring Italian expertise in document management to the world’s largest market. The choice of Dayton was linked to the presence of NCR, a prestigious technology company in the payments sector that had fostered a strong cultural ecosystem around check processing in the area.

In the period leading up to the Truncation Act (which became effective in 2004), Panini and Panini North America’s entire revenue relied on a single product called the S1. This was a massive desktop scanner made entirely of metal, a scaled-down version of the large sorters from the 1980s.

The S1 required two PCs to operate: one for sending serial commands and another for receiving check images via dedicated electronic boards.

Panini S1

Today, the answer seems obvious, but in the late 1990s and early 2000s, selling a few hundred S1 units per year left great uncertainty about what would happen after the approval of the Truncation Act and which machine would be the “right” one to address the shift.

In the meantime, Panini had introduced a modernized version of the S1 called the S1Vision; slightly smaller and with image capture sensors moved upfront, the S1Vision could be operated with a single PC. The concept of “modernized” can be misleading: the S1Vision was powered by an 8-bit Z80 processor, running at 1 MHz, with a maximum firmware size of 65,536 bytes, all meticulously written in assembly language.

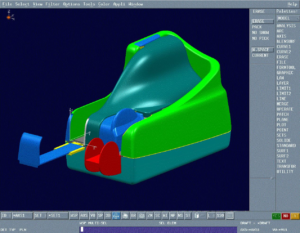

The years from 2000 to 2004 were a period of feverish activity at Panini, alternating between market analysis and prototypes of scanners suitable for bank tellers but incorporating all the features of their larger counterparts.

It’s worth clarifying that the large sorters used by banks at the time were as big as a wall, designed with absolute reliability and high performance in mind—not size reduction or cost containment.

For context, the Panini LS800 sorter was several meters long, processed 800 checks per minute, was powered by a 380-volt three-phase motor, had a main track moving at 4 meters per second, captured front and back images of checks in G4 and JPEG format, and read the MICR E13B codeline virtually without errors, as any reading issues could lead to delays and costly reprocessing.

Panini LS800

When it became clear that the Truncation Act would require a scanner smaller and cheaper than a desktop printer, the design challenges were clear: how would we transfer uncompressed front-and-back images to the application PC? What throughput in checks per minute could we achieve? How would we guarantee a high MICR read rate without excessive rejects (unread characters) or misreads (incorrectly interpreted characters) on a plastic machine with a MICR head costing just a few dollars?

An anecdote from that time: in 2000, the USB 2.0 standard was released, promising high theoretical transfer speeds. While Apple’s FireWire had been introduced earlier and offered greater bandwidth, we opted for USB 2.0. However, before the prototype of the electronic board was complete no one could predict the performance of the full system so, Ugo Panini, wanting to embed the new product’s maximum speed in its name, decided to call it MyVision ‘X.’

The MyVisionX embodied the belief that to get a truly innovative project you should entrust it to a team of beginners, it’s possible they never get things done but, if they pull it off, the result is sure to be original.

It was a year of relentless, desperate work that ended well. The industrial design was extraordinarily effective, track accessibility was unprecedented, performance was high and scalable thanks to an ingenious system of software licenses that could be purchased later, and check feeding and separation were achieved with a patented system that reduced mechanical parts and costs.

Panini MyVisionX

Panini MyVisionX

But it still wasn’t enough to reassure U.S. banks about MICR reading quality so, Ugo Panini, came up with the idea of comparing the MyVisionX with a large sorter considered the “absolute benchmark” for MICR at the time—the NCR 7780. To give a sense of proportion, the MyVisionX was sold for about $1,000, while the NCR exceeded $300,000. We found a bank with an NCR and convinced them to collect checks at the teller window for three days. These were then scanned on both the NCR and the MyVisionX for a direct comparison. The result was an astonishing tie.

NCR 7780

However, it was still necessary to convince large banks to adopt the MyVisionX to create a ripple effect for smaller banks; without a dedicated marketing department, Ugo decided to focus entirely on the strength of performance: he personally crafted a pocket-like container out of cardboard and filled it with over 100 carefully selected “difficult” checks. With a few MyVisionX units packed in a suitcase, Ugo and I traveled to banks as salesmen: I introduced the product technically, and Ugo demonstrated it by scanning the 100 checks under the amazed eyes of vice presidents. Needless to say, that cardboard pocket became iconic and is still fondly remembered by many at Panini.

The huge effort paid off: the first order in Europe came from Bank of Ireland for 1,600 units. On that occasion, Ugo told me, “I’ll be happy if this MyVisionX sells 10,000 units.” The second order came from Wells Fargo for 20,000 units. While production wasn’t prepared for such volumes, Ugo laughed and remarked, “That’s a nice problem to have.”

We understood that truncation in the U.S. had started under the best auspices. More than 20 years later and after many other successful products, the Panini MyVisionX remains a testament to that transformative era.

Job Interviews: How to do Well Link to the articles: Job Interviews : How to do well Authors: Kristen Rogers Publish Dates: OCT 4,2024 Not using these job interview tips can reduce your chances of getting that job Introduction The Job interview process can be nerve-wracking, but preparation is key to standing out from […]

Read moreOutline: From Passwords to Biometrics: Evolving Security in Mobile Banking Link to the article: Passwords to Biometrics Author: Pendleton Community Bank Publish Dates: Feb. 2, 2024 Buyer Persona: Targeted towards banks and people interested in secure identity and checks. From Passwords to Biometrics: Evolving Security in Mobile Banking Introduction In today’s fast-paced digital world, […]

Read moreOutline: Biometric Payments and Cloud Security Risks Link to the articles: JPMorgan Biometric Cloud Services Authors: Lynne Marek & Walt Williams Publish Dates: Aug. 7, 2024 & Jan. 29, 2025 Buyer Persona: Targeted towards banks and people interested in secure identity and checks. Biometric Payments and Cloud Security Risks Introduction In the ever-evolving industry […]

Read more